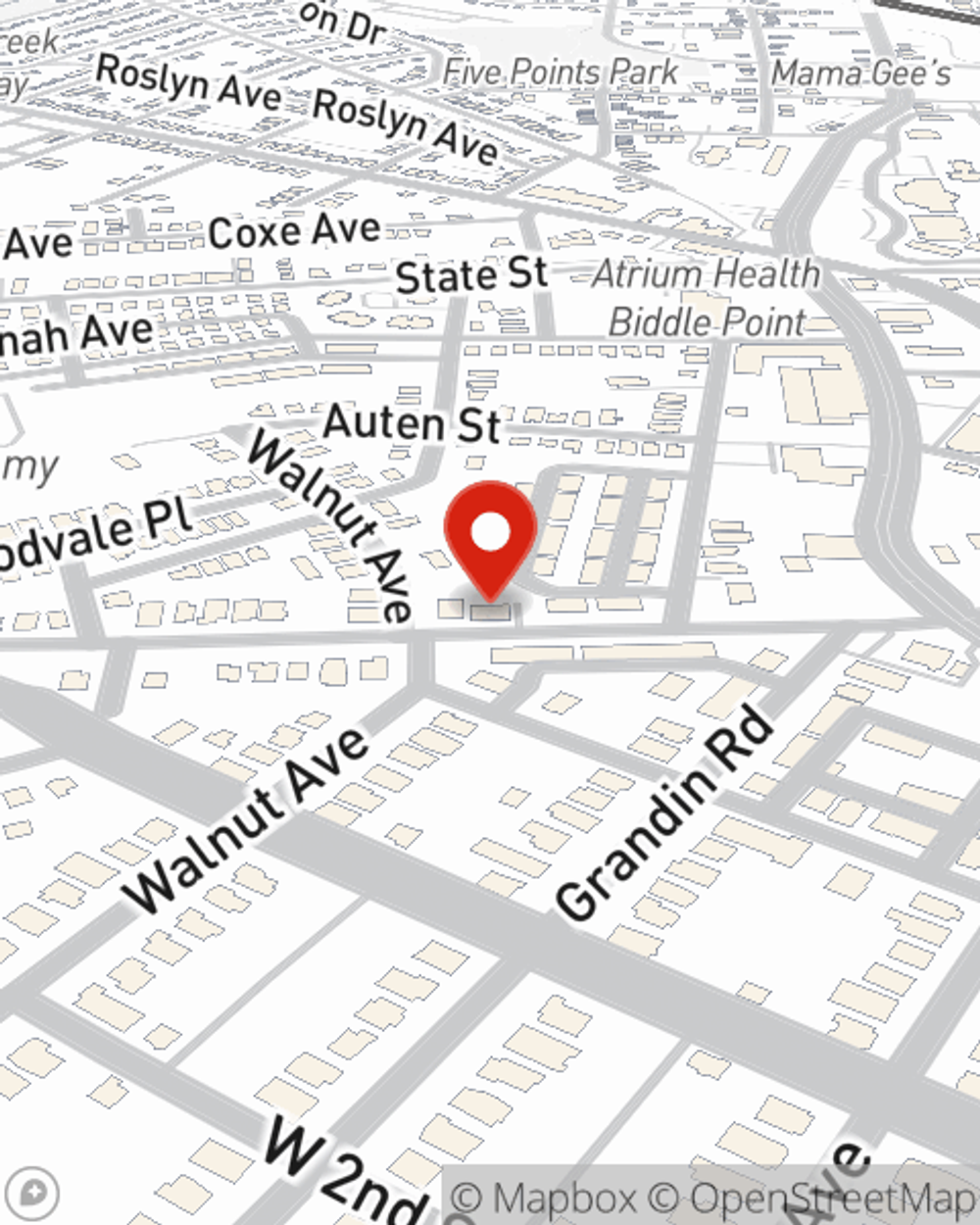

Life Insurance in and around Charlotte

Insurance that helps life's moments move on

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

- Charlotte

- Uptown Charlotte

- Mt. Holly

- Belmont

- Coulwood

- Gastonia

- Huntersville

- Cornelius

- Matthews

- Wesley Heights

It's Time To Think Life Insurance

It can be a big responsibility to take care of your family, which may include finding the right Life insurance coverage. With a policy from State Farm, you can help ensure that the people you love can maintain a current standard of living and/or pay off debts as they mourn your loss.

Insurance that helps life's moments move on

Life won't wait. Neither should you.

Life Insurance Options To Fit Your Needs

And State Farm Agent Rob Heath is ready to help design a policy to meet you specific needs, whether you want coverage for a specific number of years or coverage for a specific time frame. Whichever one you choose, life insurance from State Farm will be there to help your loved ones keeping going, even when you can't be there.

More people choose State Farm® as their life insurance company over any other insurer. Are you ready to check out what the State Farm brand can do for you? Contact State Farm Agent Rob Heath today.

Have More Questions About Life Insurance?

Call Rob at (704) 392-4166 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.

Simple Insights®

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.